By Mark Kawalya

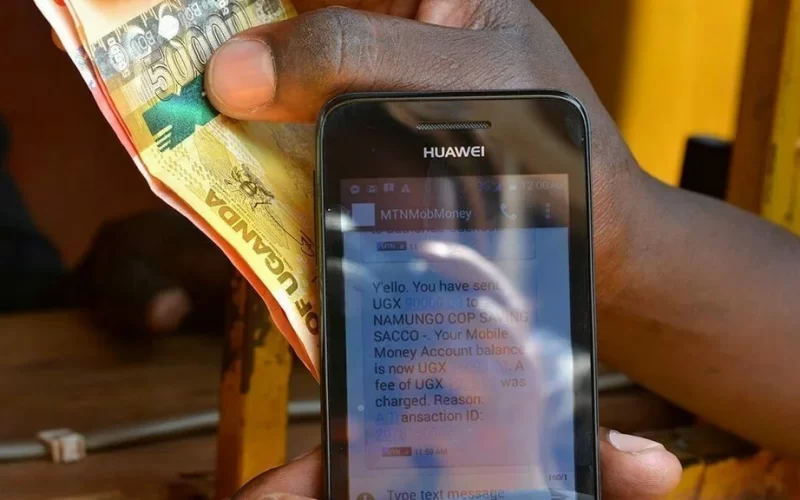

Bank of Uganda recently issued a directive mandating mobile money agents to verify customers’ identities with valid National Identity Cards for withdrawals exceeding one million shillings. The law has sparked varied reactions. Some view it as a proactive step to combat cybercrime. Others see it as a counterproductive measure that will lock those without National IDs from transacting certain amounts.

According to the new law, customers conducting transactions above one million shillings need to present a valid National ID to mobile money agents. This policy adjustment aims to address the increasing instances of fraud plaguing Mobile Money. In recent years, the Bank of Uganda has witnessed a surge in mobile money fraud often perpetrated by criminals in collusion with wayward mobile money agents.

The new regulation seeks to tighten security measures and foster safer transactions.

However, cybersecurity expert Emmanuel Chagara warns about the risks associated with heavy reliance on National Identity Cards for verification. He underscores the potential for forgery, emphasizing that the efficacy of the regulations hinges on stringent ID checks and the credibility of the national identification system.

According to the Bank of Uganda’s 2020 Financial Capability Survey, only 20% of Ugandans deposit their savings in formal financial institutions. 15% opt for mobile money services. Given these statistics, the central bank’s focus on regulating mobile money assumes paramount importance. Chagara also underscores the advantages of digital payments. He cites reduced transaction fees compared to traditional methods. Nonetheless, he stresses the importance of addressing ID forgery risks. This will ensure the success of the central bank’s policy.

As the new regulations come into force, it is essential for the central bank and stakeholders to closely monitor their impact. Striking a balance between beefing security and preserving accessibility for the millions relying on mobile money for financial transactions is key.

In related financial developments, the government, through the Excise Duty (Amendment) Bill 2024, proposes a 0.5 percent excise duty on all non-financial institution withdrawals conducted through a payment system or agent banking, effective July 2024. This levy marks the government’s first inaugural attempt to impose a direct tax on agent banking transactions since its inception in Uganda in 2017.

This proposed tax, akin to the existing levy on mobile money transactions introduced in 2018, could potentially impact the government’s financial inclusion agenda, particularly in rural areas where agent banking serves as a vital conduit for providing secure and affordable financial services in the absence of bank branches.