The Uganda Revenue Authority (URA) is leveraging technology to start collecting VAT from service provider companies that are Ugandan non-resident. The move is an effort by the taxman to maximize tax collection revenues by moving into the digital space that was previously untouched.

URA made an official notification to all these non-resident companies such as Facebook, Netflix, and others that offer online services and the consumers of their services based on section 16 of the VAT Act 2020.

However, unlike the Over the Top Tax (OTT), digital tax will be levied on the profits of the non-resident companies, resulting in the tax being passed on to the final Ugandan consumers in the form of increased subscription costs.

It is therefore likely that your Netflix and Apple Music monthly subscriptions will go up in the near future.

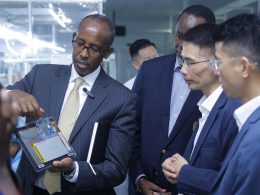

Businesses offering electronic services will be subject to these levies, which URA Commissioner General John Musinguzi attributes to the lengthy negotiations as the cause of the delay in the collection of the tax. He further adds that the tax body has put in place all the digital infrastructure that is crucial to the effective collection of the tax.

Section 16(2) of the VAT Act says that a non-resident who supplies electronic services to a non-taxable person in Uganda makes a taxable supply. Such a supplier is therefore required to charge VAT on the supply, file quarterly returns, and pay VAT due on the supply within fifteen days from the end of each quarter.

Firms offering web hosting services along with those supplying images, information, self-education packages, gambling, music, and films will have to contend with the new tax. By estimation, the Ugandan government will collect 2 trillion shillings more, with the bulk of this coming from electronic service suppliers.

“We are left with only one option, we must efficiently collect revenues from within the country, and we must mobilize more stakeholders to join us in this effort,” Musinguzi said.

This seems to be a trend in Africa, as Nigeria and Zimbabwe are the latest countries that have rolled out plans for collecting taxes from e-commerce and digital service providers like Youtube, Amazon, and Netflix.

Countries that already have the tax in place charge a certain percentage, like Kenya, which stands at 1.50% on gross transaction value, while Nigeria is working on a 6% tax on turnover.