By Mark Kawalya

Uganda’s telecommunications sector has, in the first half of the financial year, fallen to the fourth position from the usual top two tax payers that contribute the largest chunk of tax revenue to Uganda. The drop is from the usual UGX2 trillion to a low of UGX800 billion.

Information from URA indicates that the tax body was only able to collect UGX 824 billion for this half-year period. This drop in revenues is attributed to the extensive investments that Uganda’s two major telecoms, MTN Uganda and Airtel, are making in upgrading their networks.

The telecoms have invested substantially in procuring equipment that is critical in boosting network capacity and expanding coverage into new areas.

The tax body hopes that for the next half of the financial year, the telecoms will not have significant investment in their networks so that tax collections will bounce back to the UGX2 trillion range that the sector has previously been contributing.

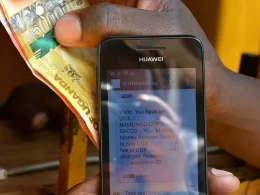

While URA experienced shortfalls in tax collection for the first half of the year, some revenue was collected from the use of digital services in the form of VAT from platforms such as Netflix, Meta, Facebook, Zoom, and Amazon along with other marketing platforms.

According to the URA, Facebook generates revenue in Uganda, of which the tax body collects a portion in the form of tax.

However, according to an IMF working paper titled “Taxing Telecommunications in Developing Countries,” governments often face a dilemma regarding taxing players in the telecom industry. On one hand, they recognise that telecom services are a critical input into a nation’s economic and productivity growth due to the social inclusion effect they offer. It is the government’s wish, therefore, that telecoms provide services cheaply and to as many people as possible, leading to the introduction of new technologies. As telecoms offer support to vital services such as health, banking, and education, governments often face a tricky situation in determining the level of taxation for telecoms that is appropriate.