By Mark Kawalya

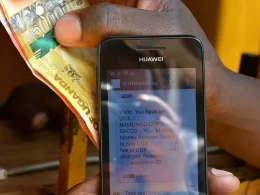

Xente has entered a partnership with Visa, a global digital payments player and Ecobank that will enable the Ugandan fintech to issue physical and virtual Visa-enabled cards to businesses. By offering its business clients the ability to make offline and online Visa payments and manage business expenses Xente, will be positioned as one of the few fintechs in East Africa that integrates international standard payment protocols as part of its portfolio.

Godfrey Kabyanga, State Minister for ICT, presided over the launch and said, “Xente has been our baby at the ministry, we have given them support.” He advised the youth to take advantage of the good policies put in place by the government in order to engage in business and grow.

The partnership, according to Allan Rwakatungu, Xente’s founder and CEO, is a result of the complexities associated with managing a business and its money, and thus, the solution will help accounting teams manage the complexity in a one-stop platform, saving companies a lot of money and countless person-hours.

The three-way partnership will enable businesses and their teams to make online and offline transactions, from any location in the world, allowing their financial departments to monitor and control spending in real time.

Xente’s Visa-enabled business cards will offer businesses versatility to pay online vendors, make payments for travel, per diem, petty cash, meals as well as make reimbursements and disbursements.

Corine Mbiaketcha,Visa’s Vice President and General Manager for East Africa, said “We believe fintechs have the power to unlock unique opportunities for us and our clients. Such collaborations at country level will empower business owners to digitize their payments and avoid inefficiencies related to cash and paper-based systems, while taking control of and effectively managing their finances and business expenses. “We are confident that with Xente, we will perform well in the market,” she said.

She further noted that small and medium-sized enterprises (SMEs) today represent about 90 percent of job creation in Africa, and their impact as economic growth drivers cannot be overemphasized in a country like Uganda with an expected GDP growth of 4.6 percent.

Grace Muliisa, Ecobank Uganda’s Managing Director, commended Xente and Visa for the initiative. She said, “As Ecobank, we understand that financial inclusion can ultimately contribute to economic development. This collaboration to issue the Xente Visa business cards is an additional demonstration of Ecobank’s commitment to provide affordable, simple and innovative solutions to support corporates across Africa, which is a key strategic driver to achieving the goal.”