By Mark Kawalya

Access to capital is one of the major impediments that small and medium enterprises (SMEs) in Africa face. Shunned by traditional financial institutions due to lack of collateral, many of these firms struggle to get by. This is despite there being more than 44 million SMEs on the continent accounting for more than 80% of jobs.

Numida, a Ugandan based fintech, has to date provided more than $20 million in unsecured financing to 27,000 SMEs. Founded in 2017 by Mina Shahid, Ben Best and Catherine Denis, the firm has raised $12.3 million in an equity and debt funding round to strengthen its presence in Uganda and expand its footprint into other countries on the African continent.

The pre-Series A of 7.3 million equity round was headlined by Serena Venture. Other participating firms included Breega, Launch Africa, Y Combinator, 4Di Capital, and MFS Africa, an already existing investor. The round will be brought to a close with $5 million in debt from Lendable Asset Management.

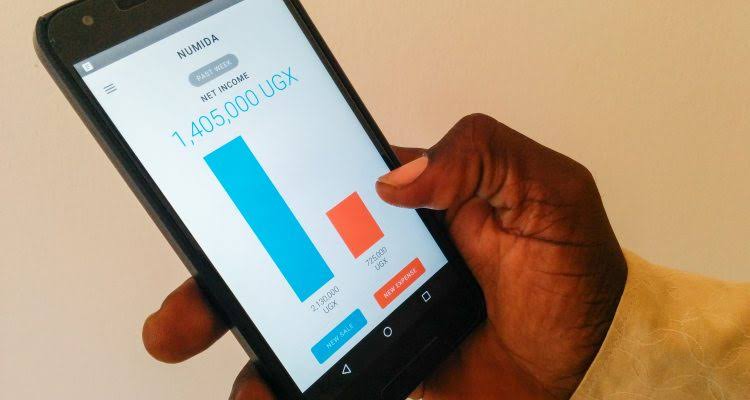

With a robust proprietary credit model that is tech buttressed, Numida is able to offer unsecured working capital loans to African SMEs. Business owners are able to borrow from the firm by simply downloading its app, filling in the loan application and receiving capital within a day.

The cash is disbursed to the applicant’s mobile wallet in a seamless, hustle-free process.

Across East Africa, Numida is the first startup that offers risk-based pricing, with business owners able to access loans of up to $4,000.

According to CEO and co-founder Mina Shahid, Numida spent years fine-tuning its user interface in order to provide a technology-based solution to Ugandans. “It’s very different from designing a mobile app for someone who has never used a computer, which is the majority of our customers, compared to designing a mobile app for somebody who is tech savvy.”

He also revealed that the company had piloted the idea in Ghana and also considered Kenya but decided to go with Uganda due to the country’s market size of financially excluded SMEs.

Since the firm’s $2.3 million raise in April 2021, the firm has seen a rise in female users from 33% to 50%. Shahid notes that this was his proudest achievement as the company wanted to drive financial gender inclusion in Uganda.